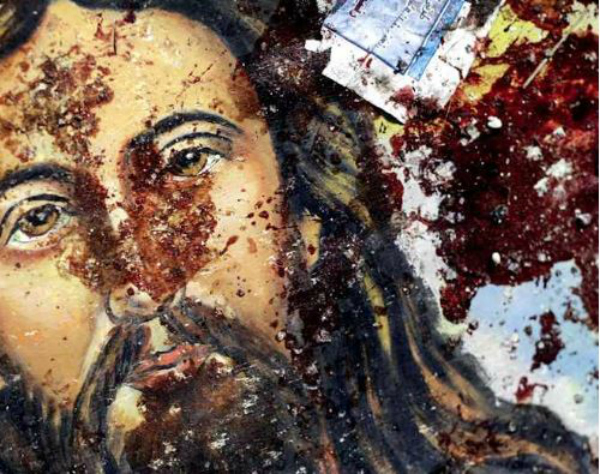

Archbishop Diarmuid Martin has said that while “there is no such thing as the ideal family”, nonetheless “there is an ideal of family,” which is what the Church is seeking to promote through the international gathering of families due to take place in Dublin in August 2018. He was speaking at the launch of the World Meeting of Families in Knock on Monday as families from across Ireland met at the shrine to celebrate the one-year countdown to next year’s event which Pope Francis is expected to attend. The 2018 gathering’s icon of the Holy Family was unveiled and anointed at the Mass and will begin a journey through the 26 Catholic dioceses in Ireland. Archbishop of Dublin Diarmuid Martin presided at the basilica’s 3pm Mass where he preached on the theme “When Plates Fly: Pope Francis on the joys and challenges of family life”. There was no family “that is ideal”, he said. “Plates fly in every family. There are, however, great families who struggle, at times heroically. The celebration of a World Meeting of Families would be hypocritical were it to be a celebration that ignored this struggle,” the Archbishop said. “A civilization of love must involve the search for a new politics for families, a politics of care for the marginalised and those who struggle. Where human love fails or is imperfect, our response should not just be that of condemnation or exclusion, but one of allowing the medicine of mercy to lead people towards a more perfect love,” he said.

A heterosexual couple who want to enter a civil partnership instead of getting married have been granted the right to take their case to the UK Supreme Court. The couple are currently prevented from doing so by the Civil Partnership Act 2004, which only applies to same-sex couples, and they argue the State’s position is “incompatible with equality law”.

The couple say that not all families are comfortable with marriage, but want the “financial and legal protection” that a civil partnership provides. The Equal Civil Partnerships Campaign argues marriage comes with religious connotations and notions of patriarchy. Rebecca Steinfeld, who is bringing the case with her partner, Charles Keidan, said: “We hope the Supreme Court will deliver a judgment that will finally provide access to civil partnerships for thousands of families across the country.” Theirs solicitor Louise Whitfield said: “This is a very significant achievement for my clients as the Supreme Court only gives permission for a very small number of cases each year – those that are the most important for the court to consider.”

Sinn Fein ‘intransigence’ is preventing Northern Ireland politicians from dealing with growing problems in health, education and the economy, the Democratic Unionists have claimed. The DUP were responding to criticism levelled by Sinn Fein that they are the ones halting the formation of a powersharing administration. Senior DUP member Simon Hamilton said the executive should be formed immediately, with a parallel process instigated to deal with the outstanding issues such as the Irish language and the ban on same sex marriage.

He told BBC Radio Ulster: “The DUP would go up to Stormont this morning and form a government and deal with those difficult issues that there are around health, around education and the economy which we believe are more important than the issues which Sin Fein are stalling the restoration of an executive on. They are the only party that are blocking the restoration of an executive to deal with those difficult issues and there are many who are coming to the conclusion that Sinn Fein do not actually want to go back into government, that they are not serious about restoring devolution.”

The Bishops of Chile have sharply criticised a Supreme Court ruling that a bill that ended Chile’s ban on abortion is constitutional. The judgement paves the way for abortion to be legalised if the baby is conceived in rape, if the mother’s life is at risk, or if the baby is not expected to survive the pregnancy.

In their message, the bishops said the resolution adopted “offends the conscience and the common good of the citizens.” They add that society as a whole loses with the legalisation of abortion in Chile, even if it’s only under certain conditions: “We are confronted with a new situation in which some unborn human beings are left unprotected by the State in this basic and fundamental right.”

The note, signed by the heads of the Chilean bishops’ conference, also says that from this point on, “our option for life is translated in redoubling our effort to continue accompanying women who live with their pregnancies in extreme situations, those who choose to see it to term, and those who think abortion is a solution.”

The High Court in Belfast yesterday refused to make same-sex marriage legal in the jurisdiction. Mr Justice O’Hara said: “It’s not the role of a judge to decide social policy, that is for the Executive and the Assembly under our Constitution.” Two gay couples took the case and argued that the refusal to legislate for same-sex marriage breaches their entitlement to family life and marriage under the European Convention on Human Rights. In the proceedings, Northern Ireland was described as “a blot on the map” seen by the rest of the world as backward-looking and divided. The judge however said the challenge was going against all recent European case law. “Put simply, the Strasbourg court has not recognised any right to same-sex marriage,” said Mr Justice O’Hara. In a separate case, the judge also ruled there was no discrimination in the North’s refusal to recognise same-sex marriages from elsewhere in the UK, treating them instead as civil partnerships. He said: “The Strasbourg court has held that same-sex marriage is not even a (European) Convention right. While it’s open to government and parliament to provide for it, they are not obliged to do so and whether they do so is a matter for them, not the courts.” He added: “The judgment I have to reach is not based on social policy, but on the law.”

ABC, the Australian version of the BBC, has offered staff a counselling hotline and “trauma toolkit” to help distressed employees during the country’s upcoming same-sex marriage postal plebiscitein November. Managers have been provided with strict guidelines on how to spot a staff member who is suffering from trauma, including what is called ‘vicarious trauma’: “The potential for vicarious trauma (also known as secondary trauma, compassion fatigue and burnout) is high when we feel connected to events occurring,” the document said. “Vicarious traumatisation means that we connect with the vulnerability of the situation and may be emotionally engaged with the story or event because of this.” Those affected by a potentially traumatic event (PTE) are enocuraged to seek help: “Over 65 Peer Support Leaders are available across the ABC and provide a listening ear to anyone who needs to discuss a PTE”.

Some politicians have sharply criticised the move. “I want to know where the Christian helpline is, particularly after the ABC themselves broadcast outrageous slurs against those who go to church, incorrectly claiming they were more likely to engage in domestic violence,” Senator Matthew Canavan told The Australian yesterday. “They have no authority in these debates to be taking the moral high ground when they have been some of the worst perpetrators of prejudice and bigotry in the last few months.” Liberal senator Eric Abetz said it showed the “gross and deliberate bias” of the taxpayer-funded broadcaster, “highlighted by the clear assumption that only one side of the debate might be dealt with inappropriately”.

“There is no offer of counselling and assistance for those that might be vilified and attacked for holding a view opposed to the ABC’s groupthink in favour of changing the definition of marriage,” Senator Abetz said.

He said the hostility came from a “new ‘religious’ consensus” formed from a “combination of scepticism, consumer appetite and political intolerance”. “It masks itself with progressive vocabulary, but its targets tend to be practising Christians.”

“We Christians in the Middle East … are the indigenous communities of these countries,” Patriarch Younan said, noting that it was in this region that Christianity was born. “We’ve been there for millennia and we have been always persecuted. And now … our very survival is at stake.” Regrettably, Patriarch Younan said, Western leaders have succumbed to “pandering” and utilizing “politically correct language” in their dealings with the Middle East. He said that, unless the United States and European nations demonstrate that they have the political will to speak honestly with the region’s leaders, helping them to create “a civilized constitution” and insisting that they separate religion and politics, “there is no hope for the future.”