Our new briefing paper looks at the operation of Britain’s abortion law, including the prevalence and the grounds for abortion. Pro-choice groups in Ireland want us to adopt a UK-style abortion law at a minimum. In the UK, one in every five pregnancies ends in abortion. You can download the briefing note from here.

Under the Irish tax code, a married couple on one income can pay thousands more in tax each year compared with a double-income married couple earning the same amount. For example, a single-income married couple on €65,600 per annum, will pay more than €12,000 in tax while a double-income married couple also earning €65,600 will...

A briefing note from The Iona Institute sets out what child-care choices the public really want to make. Only a small minority (17pc) want to place young children in day-care, 49pc want to mind their young children at home, while 27pc want another family member to look after their children during the working day. Yet,...

A recent paper from The Iona Institute shows that families today are massively penalised by the tax system compared with families in the past.

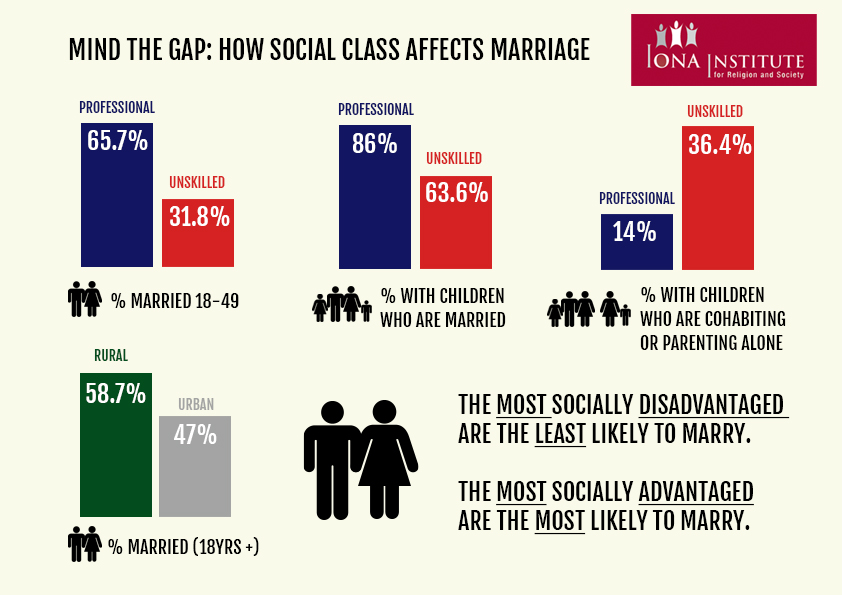

‘Mind the Gap’, a new report from The Iona Institute, shows how a person’s chances of marrying are hugely affected by the social class they are born into. The report shows that upper professional workers are more than twice as likely as unskilled workers to be married. The huge discrepancy shows that there are formidable...

If we pass the marriage referendum as the Government wants, it will have profound changes on how we view the family in our law. A major legal opinion commissioned by The Iona Institute examines this question. It shows that our ability to give preference to motherhood and fatherhood in Irish law will be severely and...

The Equality Authority is examining Section 37 of the Employment Equality Act which allows religious employers to protect their ethos. It has invited submissions from interested parties. Here is the submission of The Iona Institute.

The Iona Institute has published a major new report based on Census 2011 called ‘Marriage Breakdown and Family Structure in Ireland’. The report shows that between 1986 and 2011 there has been a 500 percent increase in the number of broken marriages in Ireland (affecting 247,000 adults in total).

Tax individualisation unfairly increases the pressure on parents of young children to be in paid employment, rather than care for children at home. The Iona Institute’s pre-Budget submission suggests some ways that this unfairness might be reduced. You can read the submission in full here.

The Constitutional Convention is to consider the issue of same-sex marriage at next month’s meeting. The Iona Institute has made a submission to the Convention, outlining the reasons why the definition of marriage should not be changed.